- What Is Sequence of Returns Risk (SORR)?

Sequence of returns risk is the danger of retiring during a downturn, when early withdrawals can permanently damage your portfolio.

Sequence of returns risk is the danger of retiring during a downturn, when early withdrawals can permanently damage your portfolio. - What Is the CAPE-Based Dynamic Withdrawal Strategy?

A CAPE-based dynamic withdrawal strategy adjusts spending based on market valuations, helping retirees preserve portfolios and reduce sequence-of-returns risk.

A CAPE-based dynamic withdrawal strategy adjusts spending based on market valuations, helping retirees preserve portfolios and reduce sequence-of-returns risk. - The 50-Year Mortgage: Why It Isn’t the Solution We Need

A 50-year mortgage lowers monthly payments but increases lifelong debt, offering illusionary affordability while worsening long-term financial freedom.

A 50-year mortgage lowers monthly payments but increases lifelong debt, offering illusionary affordability while worsening long-term financial freedom. - What is the Great Wealth Transfer?

The Great Wealth Transfer will shift trillions from older generations to younger ones, reshaping personal finance, investing, and wealth planning.

The Great Wealth Transfer will shift trillions from older generations to younger ones, reshaping personal finance, investing, and wealth planning. - What is the pro rata rule?

The pro rata rule affects IRA conversions, ensuring taxes are calculated fairly when accounts have both pre-tax and after-tax funds.

The pro rata rule affects IRA conversions, ensuring taxes are calculated fairly when accounts have both pre-tax and after-tax funds. - $346K at 31: Q3 2025 financial recap

Q3 2025 recap: strong net worth growth, high investment contributions, Etsy side hustle success, and managing higher living costs.

Q3 2025 recap: strong net worth growth, high investment contributions, Etsy side hustle success, and managing higher living costs. - What is American exceptionalism?

American exceptionalism reflects the resilience and long-term growth of U.S. markets, guiding investors in portfolio strategy and risk management.

American exceptionalism reflects the resilience and long-term growth of U.S. markets, guiding investors in portfolio strategy and risk management. - The stuff you aspire to own is a trap

The pursuit of material possessions can trap us. Instead, focus on experiences and relationships to enrich your life.

The pursuit of material possessions can trap us. Instead, focus on experiences and relationships to enrich your life. - You need to make more money

Increasing your income, whether through raises or side hustles, is essential for faster financial growth and independence.

Increasing your income, whether through raises or side hustles, is essential for faster financial growth and independence. - Facing rising housing costs: Renting vs. buying to avoid lifestyle inflation

Rising housing costs can feel out of control, but with strategy, you can manage the impact while keeping long-term goals intact.

Rising housing costs can feel out of control, but with strategy, you can manage the impact while keeping long-term goals intact. - $313K at 31: Q2 2025 financial recap

In Q2 2025, I saw strong financial growth despite a challenging year. Here’s a look at my income, investment contributions, and how I’m managing increasing costs.

In Q2 2025, I saw strong financial growth despite a challenging year. Here’s a look at my income, investment contributions, and how I’m managing increasing costs. - What is a bridge account?

A bridge account helps manage short-term financial needs during transitions, such as buying a home or retirement.

A bridge account helps manage short-term financial needs during transitions, such as buying a home or retirement. - Why you shouldn’t settle for just any raise

Don’t settle for a raise that only matches inflation. Learn how to advocate for a raise that builds wealth.

Don’t settle for a raise that only matches inflation. Learn how to advocate for a raise that builds wealth. - What is a backdoor Roth IRA?

A backdoor Roth IRA allows high earners to contribute to a Roth IRA by first using a traditional IRA.

A backdoor Roth IRA allows high earners to contribute to a Roth IRA by first using a traditional IRA. - Your partner matters

Your partner plays a crucial role in your financial success—alignment in goals, values, and communication is key.

Your partner plays a crucial role in your financial success—alignment in goals, values, and communication is key. - What is the 25X rule?

The 25X rule helps determine how much you need to save for retirement by multiplying annual expenses by 25.

The 25X rule helps determine how much you need to save for retirement by multiplying annual expenses by 25. - Lean FIRE, Chubby FIRE, and Fat FIRE: What’s the difference?

Learn the differences between Lean FIRE, Chubby FIRE, and Fat FIRE, and discover which path fits your retirement goals.

Learn the differences between Lean FIRE, Chubby FIRE, and Fat FIRE, and discover which path fits your retirement goals. - How much money do you need to buy a home?

Ready to buy a home? Here’s what you really need to know about the costs involved and how to prepare.

Ready to buy a home? Here’s what you really need to know about the costs involved and how to prepare. - Who pays tariffs?

Learn who actually pays tariffs, how they affect your budget, and how to adjust your investments accordingly.

Learn who actually pays tariffs, how they affect your budget, and how to adjust your investments accordingly. - Where to keep cash for a down payment

Learn where to keep your down payment savings based on time horizon and risk tolerance, from high-yield savings to stocks.

Learn where to keep your down payment savings based on time horizon and risk tolerance, from high-yield savings to stocks. - What I learned from almost buying a house

I made my first house offer, learned key lessons, and now feel better prepared for future real estate opportunities.

I made my first house offer, learned key lessons, and now feel better prepared for future real estate opportunities. - Why it’s especially important to buy and hold during a downturn

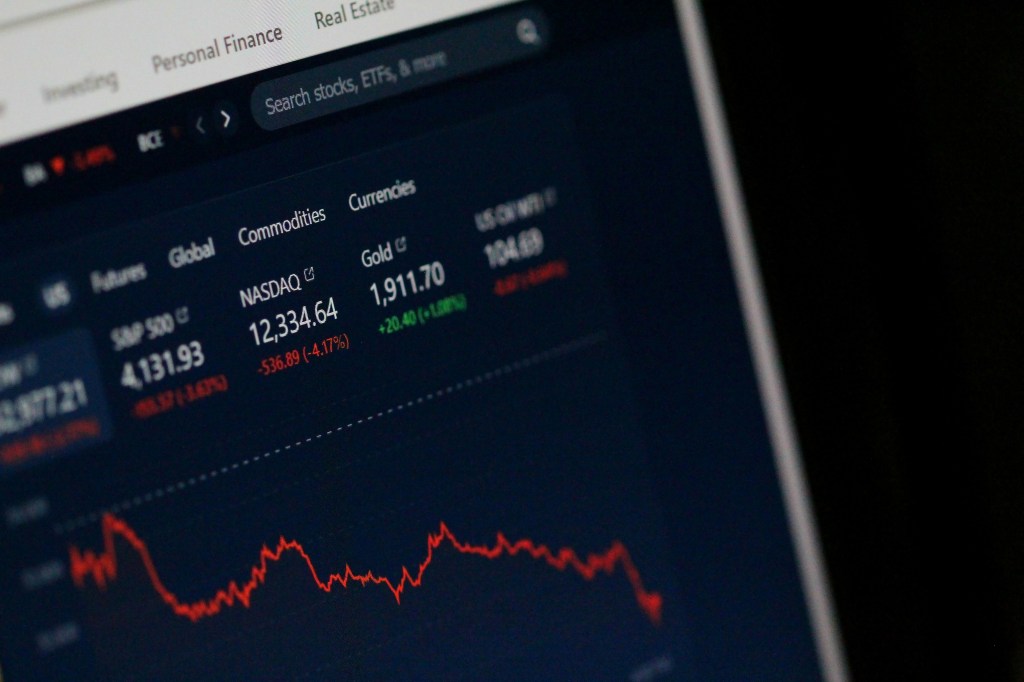

Stay disciplined during market downturns by using a buy-and-hold strategy, dollar cost averaging, and focusing on long-term goals.

Stay disciplined during market downturns by using a buy-and-hold strategy, dollar cost averaging, and focusing on long-term goals. - $279K at 31: Q1 2025 financial recap

Despite a challenging start to 2025 and market downturns, I’m staying committed to my long-term investing strategy and financial goals.

Despite a challenging start to 2025 and market downturns, I’m staying committed to my long-term investing strategy and financial goals. - The ideal age to get married, have a child, buy a home, and retire

Reflecting on the ideal age for milestones like marriage, having children, buying a home, and retiring, based on data from Pew Research.

Reflecting on the ideal age for milestones like marriage, having children, buying a home, and retiring, based on data from Pew Research. - How much should you save as a percentage of your income?

Aiming for financial independence and flexibility, saving 50% of your income is an aggressive but effective strategy for wealth building.

Aiming for financial independence and flexibility, saving 50% of your income is an aggressive but effective strategy for wealth building. - Am I worried? Yes. Am I changing my plans? No.

In times of uncertainty, maintaining consistency with your financial plan, investing, and staying disciplined is key to long-term success.

In times of uncertainty, maintaining consistency with your financial plan, investing, and staying disciplined is key to long-term success. - What is an FSA and HSA? Understanding the differences and benefits

Learn the key differences between FSA and HSA, their tax advantages, and how to use them to save on healthcare costs.

Learn the key differences between FSA and HSA, their tax advantages, and how to use them to save on healthcare costs. - Steps to take if you’re worried about losing your job

Prepare for job insecurity by building an emergency fund, cutting expenses, upskilling, and considering a side hustle to stay financially secure.

Prepare for job insecurity by building an emergency fund, cutting expenses, upskilling, and considering a side hustle to stay financially secure. - What is the third generation curse?

The third-generation curse refers to the loss of wealth by the third generation; learn how to avoid it through financial education and planning.

The third-generation curse refers to the loss of wealth by the third generation; learn how to avoid it through financial education and planning. - How long does it take to become a millionaire?

The journey to becoming a millionaire takes time, but with disciplined saving, investing, and living below your means, it’s achievable.

The journey to becoming a millionaire takes time, but with disciplined saving, investing, and living below your means, it’s achievable. - What is an FHA loan and how can you use it when house hacking?

An FHA loan is a great option for house hacking, offering low down payments and access to rental income for building wealth.

An FHA loan is a great option for house hacking, offering low down payments and access to rental income for building wealth. - What is house hacking?

House hacking allows you to buy a multi-unit property, live in one unit, and rent the others to offset expenses.

House hacking allows you to buy a multi-unit property, live in one unit, and rent the others to offset expenses. - How will investors be impacted if the CFPB is eliminated?

If the CFPB is eliminated, investors may face increased market volatility, riskier financial products, and weakened consumer protection.

If the CFPB is eliminated, investors may face increased market volatility, riskier financial products, and weakened consumer protection. - Staying the course

In times of uncertainty, staying calm and sticking to your long-term investing strategy can lead to better financial outcomes.

In times of uncertainty, staying calm and sticking to your long-term investing strategy can lead to better financial outcomes. - Save money on furniture by buying quality

Discover how buying quality used furniture can save you money and add long-lasting value to your home.

Discover how buying quality used furniture can save you money and add long-lasting value to your home. - What is a three-fund portfolio?

A three-fund portfolio is a simple, diversified investment strategy that includes U.S. stocks, international stocks, and bonds.

A three-fund portfolio is a simple, diversified investment strategy that includes U.S. stocks, international stocks, and bonds. - You need pet insurance

Pet insurance isn’t just a luxury – it’s a financial safety net that ensures your pets stay healthy without jeopardizing your own financial health.

Pet insurance isn’t just a luxury – it’s a financial safety net that ensures your pets stay healthy without jeopardizing your own financial health. - Understanding the FIRE, coast FIRE, and FINE movements

FIRE, Coast FIRE, and FINE are paths to financial independence, each with unique strategies for achieving freedom.

FIRE, Coast FIRE, and FINE are paths to financial independence, each with unique strategies for achieving freedom. - How to save money on groceries

Learn how to save money on groceries with planning, bulk buying, budget-friendly recipes, and minimizing food waste.

Learn how to save money on groceries with planning, bulk buying, budget-friendly recipes, and minimizing food waste. - What is salary benchmarking and why is it important?

Salary benchmarking helps you assess your worth, negotiate pay, and plan your career path by comparing your salary to industry standards.

Salary benchmarking helps you assess your worth, negotiate pay, and plan your career path by comparing your salary to industry standards. - How I negotiated a 13% raise

Learn how to successfully negotiate a raise by building rapport, benchmarking your salary, and showcasing your performance.

Learn how to successfully negotiate a raise by building rapport, benchmarking your salary, and showcasing your performance. - New year thoughts

Reflecting on 2024 and planning for 2025, including goals for investing, marriage, home buying, and family decisions.

Reflecting on 2024 and planning for 2025, including goals for investing, marriage, home buying, and family decisions. - The “no buy” challenge

The “no buy” challenge helps individuals reduce overconsumption, save money, and simplify their lives by avoiding non-essential purchases.

The “no buy” challenge helps individuals reduce overconsumption, save money, and simplify their lives by avoiding non-essential purchases. - How to save money for a house

Learn how to save for a home amidst rising prices and high interest rates with practical tips and strategies.

Learn how to save for a home amidst rising prices and high interest rates with practical tips and strategies. - How much to spend on an engagement ring

How to choose the right engagement ring based on your budget, values, and personal preferences – not societal expectations.

How to choose the right engagement ring based on your budget, values, and personal preferences – not societal expectations. - $282K at 30: Q4 2024 financial recap

Reflecting on 2024, I discuss my financial growth, lessons learned, and goals for 2025, including investment strategies and side hustles.

Reflecting on 2024, I discuss my financial growth, lessons learned, and goals for 2025, including investment strategies and side hustles. - Reflecting on 2024 and looking ahead to 2025

Reflecting on 2024, I’m proud of my progress despite challenges and look forward to building on these achievements in 2025.

Reflecting on 2024, I’m proud of my progress despite challenges and look forward to building on these achievements in 2025. - What is APR on a credit card?

APR is the interest rate on credit cards, impacting borrowing costs. Learn how it works and ways to minimize it.

APR is the interest rate on credit cards, impacting borrowing costs. Learn how it works and ways to minimize it. - How much should I contribute to my 401(k)?

Learn how to determine how much to contribute to your 401(k) based on your goals, employer match, and tax strategy.

Learn how to determine how much to contribute to your 401(k) based on your goals, employer match, and tax strategy. - How to make money online for beginners: A guide to earning from home

Learn how to make money online with Etsy, freelancing, surveys, blogging, selling digital products, and teaching.

Learn how to make money online with Etsy, freelancing, surveys, blogging, selling digital products, and teaching. - What is personal finance?

Personal finance is about managing money to achieve financial security, including budgeting, saving, investing, and preparing for the future.

Personal finance is about managing money to achieve financial security, including budgeting, saving, investing, and preparing for the future. - What can you solve with personal finance?

Personal finance solves many challenges – from escaping debt to saving for goals, retirement, and achieving financial independence.

Personal finance solves many challenges – from escaping debt to saving for goals, retirement, and achieving financial independence. - Why is personal finance dependent upon your behavior?

Your financial success depends on your behavior, from spending and saving habits to mindset and emotional decision-making.

Your financial success depends on your behavior, from spending and saving habits to mindset and emotional decision-making. - How to stick to a budget during the holidays

Learn how to stick to a holiday budget with mindful spending, strategic shopping, and smart financial planning for a stress-free season.

Learn how to stick to a holiday budget with mindful spending, strategic shopping, and smart financial planning for a stress-free season. - The best personal finance blogs

Looking for financial advice? Check out these top personal finance blogs that focus on mindful spending, saving, and financial independence.

Looking for financial advice? Check out these top personal finance blogs that focus on mindful spending, saving, and financial independence. - How to navigate financial conversations with a romantic partner

Learn how to navigate financial conversations with your partner to build trust, align goals, and strengthen your relationship.

Learn how to navigate financial conversations with your partner to build trust, align goals, and strengthen your relationship. - Slow living for a more thoughtful financial life

Slow living encourages simplifying your surroundings and focusing on what truly matters for a fulfilling financial life.

Slow living encourages simplifying your surroundings and focusing on what truly matters for a fulfilling financial life. - Consumerism is ruining your mental health and the planet

Consumerism negatively impacts mental health and the environment. Breaking free requires mindful spending, self-reflection, and sustainable choices.

Consumerism negatively impacts mental health and the environment. Breaking free requires mindful spending, self-reflection, and sustainable choices. - $267K at 30: Q3 2024 financial recap

Despite higher living expenses and more spending, my net worth soared in Q3 2024 through disciplined investing.

Despite higher living expenses and more spending, my net worth soared in Q3 2024 through disciplined investing. - Takeaways from The Richest Man in Babylon

The Richest Man in Babylon offers timeless financial advice on saving, investing, and living below your means.

The Richest Man in Babylon offers timeless financial advice on saving, investing, and living below your means. - Implications of the “trad wife” lifestyle

The trad wife lifestyle limits financial independence, creating vulnerability through reliance on a spouse and reduced earning potential.

The trad wife lifestyle limits financial independence, creating vulnerability through reliance on a spouse and reduced earning potential. - What is doom spending?

Doom spending is impulse buying triggered by stress or anxiety. Learn why it happens and how to avoid it.

Doom spending is impulse buying triggered by stress or anxiety. Learn why it happens and how to avoid it. - Top personal finance books

Discover the best personal finance books to transform your financial future.

Discover the best personal finance books to transform your financial future. - What is the safe withdrawal rate?

Discover the importance of the safe withdrawal rate – a strategy to maintain income during retirement while preserving savings.

Discover the importance of the safe withdrawal rate – a strategy to maintain income during retirement while preserving savings. - The five foundations of personal finance: Your roadmap to financial success

The five foundations of personal finance guide you through building emergency savings, eliminating debt, and growing wealth.

The five foundations of personal finance guide you through building emergency savings, eliminating debt, and growing wealth. - Teaching your kids healthy financial habits

Teach kids healthy financial habits early, including budgeting, saving, and the power of compound interest for long-term success.

Teach kids healthy financial habits early, including budgeting, saving, and the power of compound interest for long-term success. - What is dollar cost averaging?

Dollar cost averaging is a low-stress investing strategy focused on consistency, reducing risk, and eliminating emotional decisions.

Dollar cost averaging is a low-stress investing strategy focused on consistency, reducing risk, and eliminating emotional decisions. - Are you a saver or a spender? And why it matters

Understanding whether you’re a saver or a spender helps you balance enjoying life now while securing your financial future.

Understanding whether you’re a saver or a spender helps you balance enjoying life now while securing your financial future. - Understanding financial literacy: A critical tool for financial empowerment

Financial literacy empowers individuals to manage their finances, break the poverty cycle, and achieve long-term financial stability.

Financial literacy empowers individuals to manage their finances, break the poverty cycle, and achieve long-term financial stability. - What is zero-based budgeting?

Zero-based budgeting helps you take control of your finances by assigning every dollar a job, ensuring intentional spending.

Zero-based budgeting helps you take control of your finances by assigning every dollar a job, ensuring intentional spending. - What does it mean to live paycheck to paycheck?

Living paycheck to paycheck is a phrase that gets tossed around a lot, but what is this term’s definition? In its simplest form, living paycheck to paycheck means that you’re relying entirely on your next paycheck to cover your expenses, with little to no money left over after paying for essentials like rent, groceries, and… Read more: What does it mean to live paycheck to paycheck?

Living paycheck to paycheck is a phrase that gets tossed around a lot, but what is this term’s definition? In its simplest form, living paycheck to paycheck means that you’re relying entirely on your next paycheck to cover your expenses, with little to no money left over after paying for essentials like rent, groceries, and… Read more: What does it mean to live paycheck to paycheck? - How TitTok’s “Underconsumption Core” trend can save you money and help you appreciate what you already have

“Underconsumption Core” on TikTok encourages using what you already have, reducing spending, and promoting sustainability for better finances.

“Underconsumption Core” on TikTok encourages using what you already have, reducing spending, and promoting sustainability for better finances. - What does “buy and hold” mean in investing?

The buy-and-hold strategy builds wealth by investing in index funds and holding long-term, avoiding market timing.

The buy-and-hold strategy builds wealth by investing in index funds and holding long-term, avoiding market timing. - Takeaways from Brian Preston’s Millionaire Mission

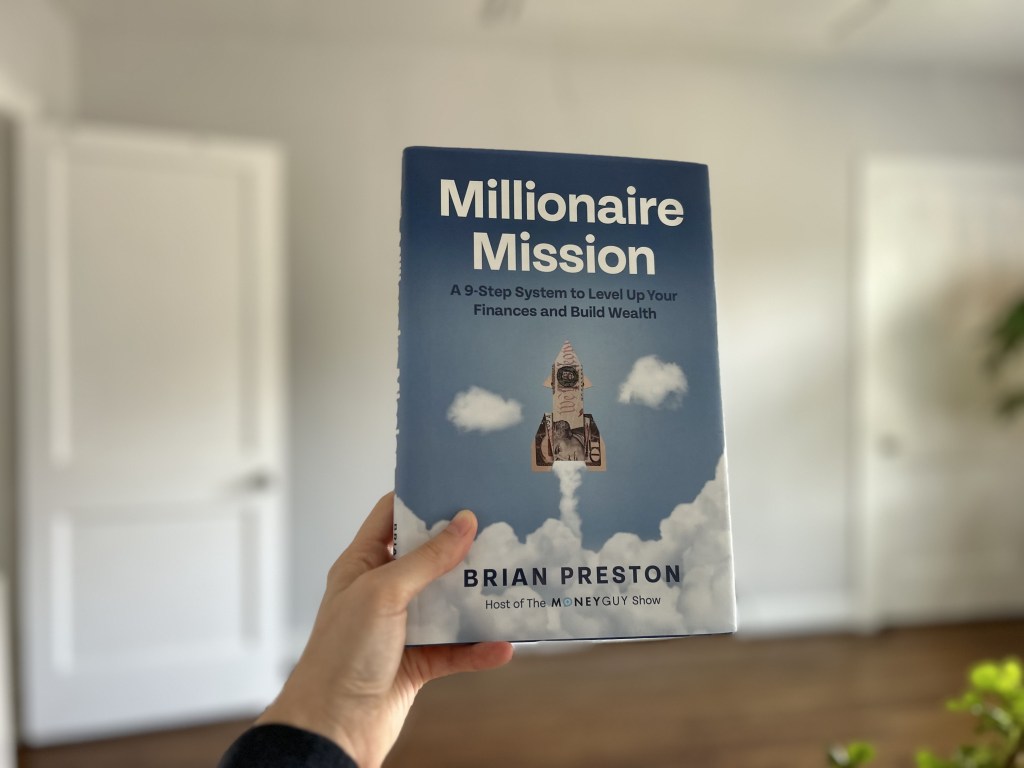

Brian Preston’s The Millionaire Mission explores building wealth through disciplined investing, avoiding consumption traps, and leveraging financial innovations.

Brian Preston’s The Millionaire Mission explores building wealth through disciplined investing, avoiding consumption traps, and leveraging financial innovations. - Riding Out a Market Downturn: Tips to Keep Your Financial Cool

Learn how to navigate market downturns by staying calm, sticking to your plan, and focusing on long-term investing.

Learn how to navigate market downturns by staying calm, sticking to your plan, and focusing on long-term investing. - Debt: When compounding interest becomes your enemy

Compounding interest on debt can hinder financial freedom, but strategic management helps you achieve a debt-free future.

Compounding interest on debt can hinder financial freedom, but strategic management helps you achieve a debt-free future. - What is a lazy girl job?

Lazy girl jobs offer low-stress work-life balance but may limit career growth and income potential at different life stages.

Lazy girl jobs offer low-stress work-life balance but may limit career growth and income potential at different life stages. - Just get started

Overcoming investing fears: Start early, educate yourself, and watch your wealth grow.

Overcoming investing fears: Start early, educate yourself, and watch your wealth grow. - How I saved $250K by 30

Reaching $250,000 net worth by 30 required early start, goal setting, living below means, consistent investing, salary increase, and financial education.

Reaching $250,000 net worth by 30 required early start, goal setting, living below means, consistent investing, salary increase, and financial education. - Planning a considerate bachelorette trip

Plan a considerate bachelorette trip by choosing invitees thoughtfully, considering location and costs, offering flexibility, and being considerate with requests.

Plan a considerate bachelorette trip by choosing invitees thoughtfully, considering location and costs, offering flexibility, and being considerate with requests. - $245K at 30: Q2 2024 financial recap

June was a rollercoaster month for my finances. While my investments performed exceptionally well, I felt like I was hemorrhaging cash due to routine but expensive vet expenses for my pets. Despite these costs, I’m still inching closer to my goal of $250K – a quarter of a million dollars! Navigating through unexpected expenses while… Read more: $245K at 30: Q2 2024 financial recap

June was a rollercoaster month for my finances. While my investments performed exceptionally well, I felt like I was hemorrhaging cash due to routine but expensive vet expenses for my pets. Despite these costs, I’m still inching closer to my goal of $250K – a quarter of a million dollars! Navigating through unexpected expenses while… Read more: $245K at 30: Q2 2024 financial recap - Why a Married Couple Might Choose to File Taxes Separately: Benefits and Pitfalls

Filing taxes jointly is common for married couples, but filing separately has benefits for handling debt, medical expenses, and student loans. However, it may lead to loss of tax credits, higher rates, and complexity. Factors, such as children, also influence this decision.

Filing taxes jointly is common for married couples, but filing separately has benefits for handling debt, medical expenses, and student loans. However, it may lead to loss of tax credits, higher rates, and complexity. Factors, such as children, also influence this decision. - Money Lessons from Netflix’s Bridgerton

Discover valuable money lessons from Netflix’s Bridgerton in our latest blog post. Learn how to manage debt, the importance of planning for the future, the power of negotiation, and investing in relationships.

Discover valuable money lessons from Netflix’s Bridgerton in our latest blog post. Learn how to manage debt, the importance of planning for the future, the power of negotiation, and investing in relationships. - The Value of a Mid-Year Financial Checkup: How to Hit Reset on Your Finances

Discover the value of a financial reset and learn essential steps to review your budget, savings, investments, and debt. We’ll guide you through reassessing your financial goals and updating your plan for the rest of the year.

Discover the value of a financial reset and learn essential steps to review your budget, savings, investments, and debt. We’ll guide you through reassessing your financial goals and updating your plan for the rest of the year. - What is a sinking fund?

Discover the power of sinking funds—a dedicated savings strategy tailored to your financial goals. Learn how to allocate funds effectively and choose the right account for your needs, whether it’s a checking, savings, or high-yield savings account.

Discover the power of sinking funds—a dedicated savings strategy tailored to your financial goals. Learn how to allocate funds effectively and choose the right account for your needs, whether it’s a checking, savings, or high-yield savings account. - Comparison is robbing you

Comparison, fueled by social media, can steal joy and impact financial health. Embrace uniqueness, recognize curated narratives, and prioritize genuine sources of happiness for contentment and well-being.

Comparison, fueled by social media, can steal joy and impact financial health. Embrace uniqueness, recognize curated narratives, and prioritize genuine sources of happiness for contentment and well-being. - Your first $100K: Reaching the boiling point

Reaching your first $100K in net worth can feel like a daunting task, but it’s a crucial milestone on your financial journey.

Reaching your first $100K in net worth can feel like a daunting task, but it’s a crucial milestone on your financial journey. - What’s the difference between an ETF and a mutual fund?

Learn the differences between Exchange-Traded Funds (ETFs) and mutual funds in investing, covering trading methods, costs, minimum investments, tax efficiency, and transparency, with examples like VTI and VTSAX, to make informed investment decisions for your financial goals.

Learn the differences between Exchange-Traded Funds (ETFs) and mutual funds in investing, covering trading methods, costs, minimum investments, tax efficiency, and transparency, with examples like VTI and VTSAX, to make informed investment decisions for your financial goals. - $231K at 30: Q1 2024 financial recap

Discover the financial highlights of my March journey, from celebrating my 30th birthday to achieving a new net worth milestone of $230K. Dive into insights on income, investment contributions, spending breakdowns, and future goals, and join the conversation as we navigate personal finance together.

Discover the financial highlights of my March journey, from celebrating my 30th birthday to achieving a new net worth milestone of $230K. Dive into insights on income, investment contributions, spending breakdowns, and future goals, and join the conversation as we navigate personal finance together. - What is money dysmorphia?

Learn how social media exacerbates “money dysmorphia,” impacting mental health and financial well-being, and discover practical strategies to combat comparison and prioritize financial progress.

Learn how social media exacerbates “money dysmorphia,” impacting mental health and financial well-being, and discover practical strategies to combat comparison and prioritize financial progress. - Budget-Friendly Travel Tips: Your Guide to Affordable Adventures

Unlocking Dream Destinations Without Breaking the Bank – Practical Strategies for Smart and Affordable Travel

Unlocking Dream Destinations Without Breaking the Bank – Practical Strategies for Smart and Affordable Travel

Subscribe

Enter your email below to receive updates.