Subscribe!

Follow along as I share strategies and lessons to help you take control of your financial future.

-

Takeaways from The Richest Man in Babylon

The Richest Man in Babylon offers timeless financial advice on saving, investing, and living below your means.

-

Implications of the “trad wife” lifestyle

The trad wife lifestyle limits financial independence, creating vulnerability through reliance on a spouse and reduced earning potential.

-

What is the safe withdrawal rate?

Discover the importance of the safe withdrawal rate – a strategy to maintain income during retirement while preserving savings.

-

The five foundations of personal finance: Your roadmap to financial success

The five foundations of personal finance guide you through building emergency savings, eliminating debt, and growing wealth.

-

Teaching your kids healthy financial habits

Teach kids healthy financial habits early, including budgeting, saving, and the power of compound interest for long-term success.

-

What is dollar cost averaging?

Dollar cost averaging is a low-stress investing strategy focused on consistency, reducing risk, and eliminating emotional decisions.

-

Are you a saver or a spender? And why it matters

Understanding whether you’re a saver or a spender helps you balance enjoying life now while securing your financial future.

-

Understanding financial literacy: A critical tool for financial empowerment

Financial literacy empowers individuals to manage their finances, break the poverty cycle, and achieve long-term financial stability.

-

What is zero-based budgeting?

Zero-based budgeting helps you take control of your finances by assigning every dollar a job, ensuring intentional spending.

-

What does it mean to live paycheck to paycheck?

Living paycheck to paycheck is a phrase that gets tossed around a lot, but what is this term’s definition? In its simplest form, living paycheck to paycheck means that you’re relying entirely on your next paycheck to cover your expenses, with little to no money left over after paying for essentials like rent, groceries, and…

-

How TitTok’s “Underconsumption Core” trend can save you money and help you appreciate what you already have

“Underconsumption Core” on TikTok encourages using what you already have, reducing spending, and promoting sustainability for better finances.

-

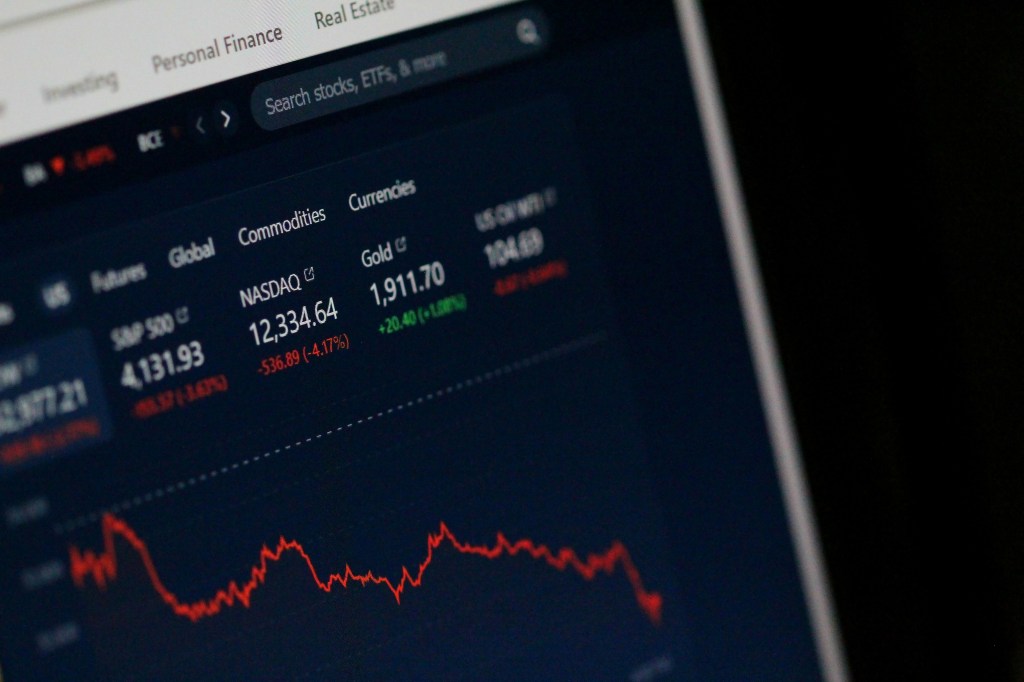

What does “buy and hold” mean in investing?

The buy-and-hold strategy builds wealth by investing in index funds and holding long-term, avoiding market timing.

-

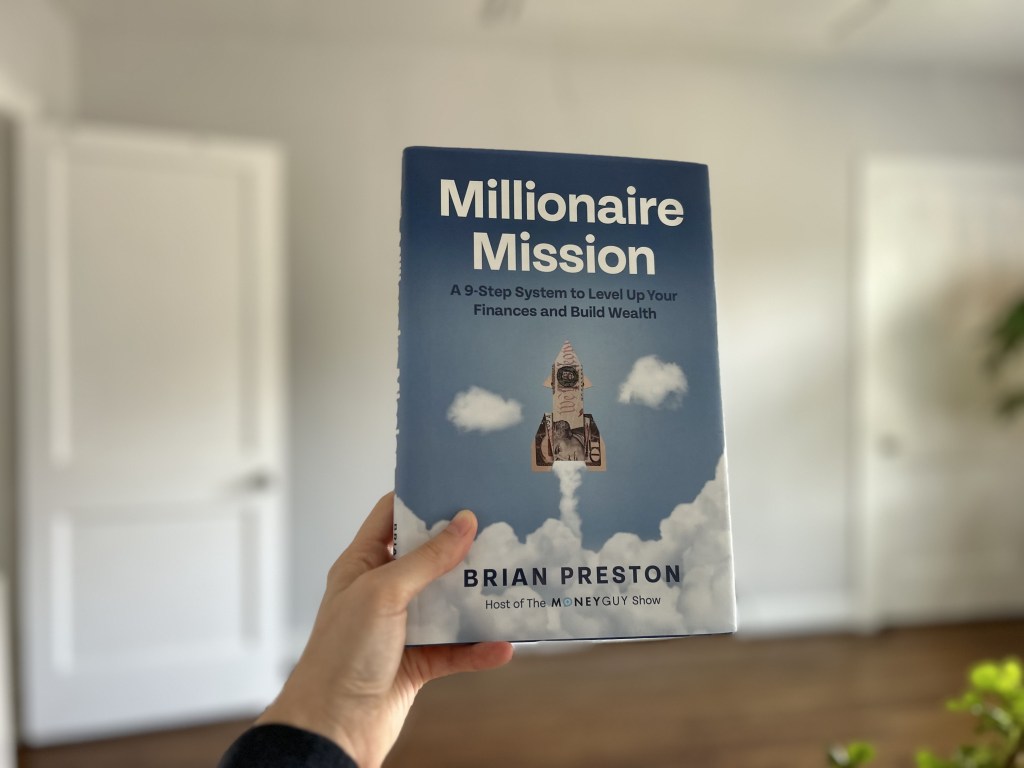

Takeaways from Brian Preston’s Millionaire Mission

Brian Preston’s The Millionaire Mission explores building wealth through disciplined investing, avoiding consumption traps, and leveraging financial innovations.

-

Just get started

Overcoming investing fears: Start early, educate yourself, and watch your wealth grow.